Annual spending priorities for the City are set each year through the budget process. Although we continue to find efficiencies in our operations and do more with less, new projects, additional service levels and rising costs of doing business often require budget increases funded through taxation.

You can't appeal your taxes. You can only appeal your assessment.Property tax notices for 2025 were mailed out this week. Most property owners will notice an increase in taxation. Two key factors driving this year’s tax increases are Revaluation and the 2025 Budget.

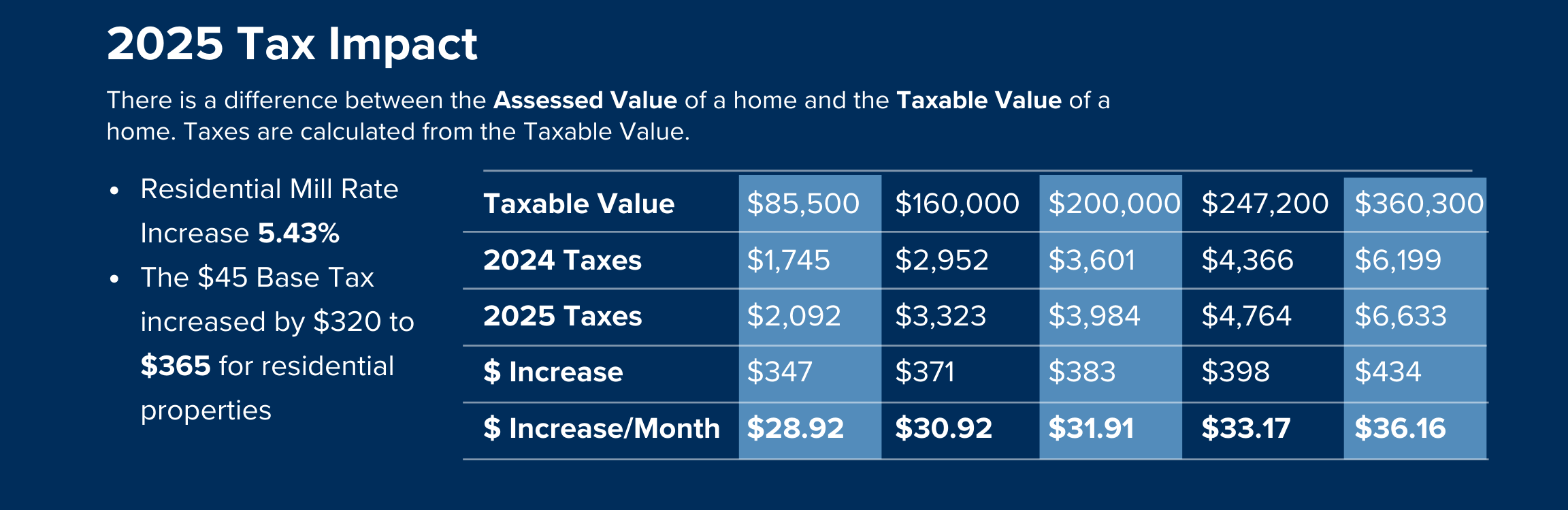

In January, Prince Albert City Council approved an $8.5 million increase to the 2025 budget. Property tax is the main source of funding for the City budget, and this year’s approved tax tool changes include a combination of mill rate and base tax increases, applied as follows:

- A 5.43% mill rate increase for residential

- $320 base tax increase for all residential properties

- $118 base tax per unit for multi-residential properties

- Tiered base tax increases for commercial properties

A portion of the property tax impact is due to the budget increase and the other is due to revaluation. Not all properties saw a tax increase as a result of revaluation.

1. Revaluation Year

- 2025 is a province-wide revaluation year. Provincial legislation requires that the assessed value of all properties within Saskatchewan be updated every four years. Property values change over time due to changing market conditions, so it is important that the data that is available reflects these changes. Property assessments were updated based on market conditions as of January 1, 2023, using verified sales data from January 2019 to December 2022.

- As a result of revaluation many properties in Prince Albert were assessed higher and since the value of your property is one factor that influences your property tax rates, revaluation has impacted property taxes. In some cases, properties have changed in value by a considerable amount.

- Certain neighbourhoods in Prince Albert are in much higher demand than others which is reflected in the market value of these properties. These strong sales drive up assessed value which is one factor that then translates into an increase in property taxes. This is the nature of the property tax system which is designed to reflect the value of the home.

- Not all properties changed equally. Your tax increase depends on how your assessment changed compared to others in the city. It is estimated that properties that saw a tax increase greater than approximately $500 were impacted by both the budget increase and revaluation changes.

- Assessment Notices were mailed in January 2025. For more information about the revaluation process and how assessments are calculated, please visit www.citypa.ca/revaluation.

2. Budget Increase

- For properties that didn’t see a significant change in assessment, the tax increase is tied to the City’s $8.5 million budget increase approved earlier this year. The increase addresses rising operational costs for essential services, including police, fire protection, salaries, road maintenance, and facility upkeep.

- The tax tools used in 2025 to raise the city's budget are a combination of a residential 5.43% mill rate increase and a base tax increase of $320 for residential properties and $118 for multi-residential properties, with tiered rates for commercial properties.

- To distribute the tax burden more evenly across properties, Council approved increases to the base tax. This approach was selected due to Prince Albert’s unique housing market, where mid-and-lower valued homes saw relatively smaller increases in assessed value. A base tax is a flat fee added to the municipal portion of each tax bill. An increase to the base tax reflects the philosophy that all properties benefit equally from essential services (such as fire, police, roads, etc) regardless of the assessed value of the property.

- Base taxes address the market shift and its dramatic impacts on higher-valued homes in Prince Albert. Higher-valued properties will still pay a larger proportion of taxes this year, as the system is designed, but not to the same extent as a mill rate increase alone.

- It is estimated that properties that saw an increase of approximately $400 or lower, were not impacted by revaluation changes.

Learn more:

Assessment: https://www.citypa.ca/en/living-in-our-community/assessing-property-value.aspx

Revaluation: https://www.citypa.ca/en/living-in-our-community/revaluation.aspx

Property Tax Rates: https://www.citypa.ca/en/living-in-our-community/tax-rates.aspx

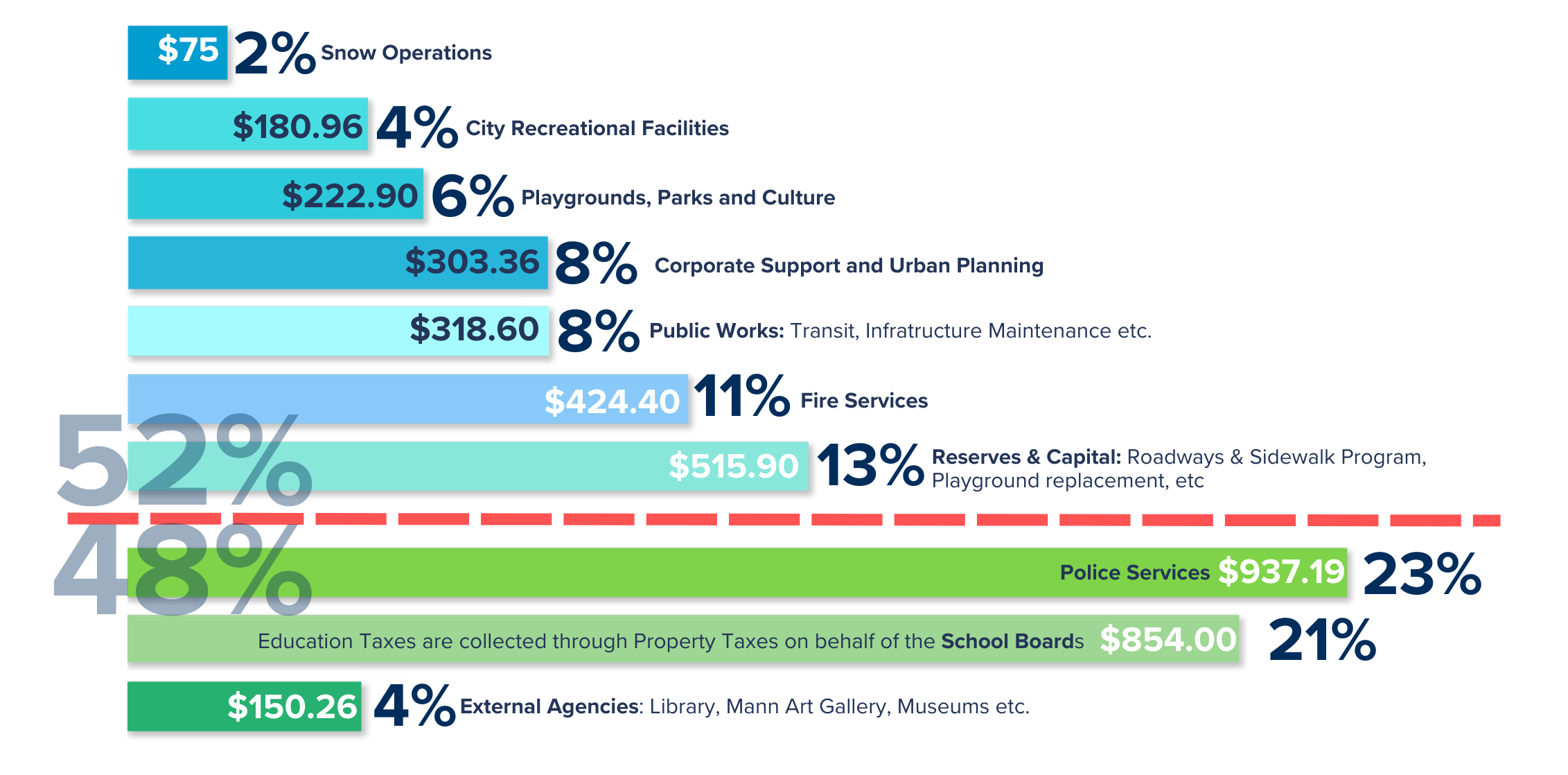

What your Property Taxes pay for:

A home in Prince Albert with a $200,000 Taxable Assessment will pay $3,984 in Property Taxes in 2025. The blue portions (52%) of your Tax Bill are allocated to City Operations, and the green portions (48%) are allocated to Other Agencies, Education Taxes and Police.

2025 Tax Plan

As a City, we are focusing on building a better Prince Albert.

The 2025 Tax Plan will raise the $8,577,515 million needed to fund 2025 priorities this year. In addition to raising the funds required, the City’s proposed property tax plan is designed to temper the impact of the 2025 revaluation on residential and commercial properties and improve the commercial-to-residential property tax ratio in the City.

| 2025 Residential Property Tax Impact |

|

Components of the proposed 2025 tax plan include:

|

| Base Taxes, Special Taxes and Mill Rates | ||||||||||||||||||||||

|

We use a combination of tax tools to raise revenues necessary to fund operations. In Prince Albert, the unique nature of the housing market has resulted in base taxes being used more often to reduce the tax load being carried by fewer higher valued homes.

|

||||||||||||||||||||||

| Understanding Base Taxes, Special Taxes and Levies | ||||||||||||||||||||||

|

The property tax system is designed to apply taxes according to value of your home. This is called the ad valorem system. The general principle is that the higher the value the property, the higher the property taxes. Different types of tax tools are available to cities to provide some flexibility in how tax rates are applied:

|

||||||||||||||||||||||

|

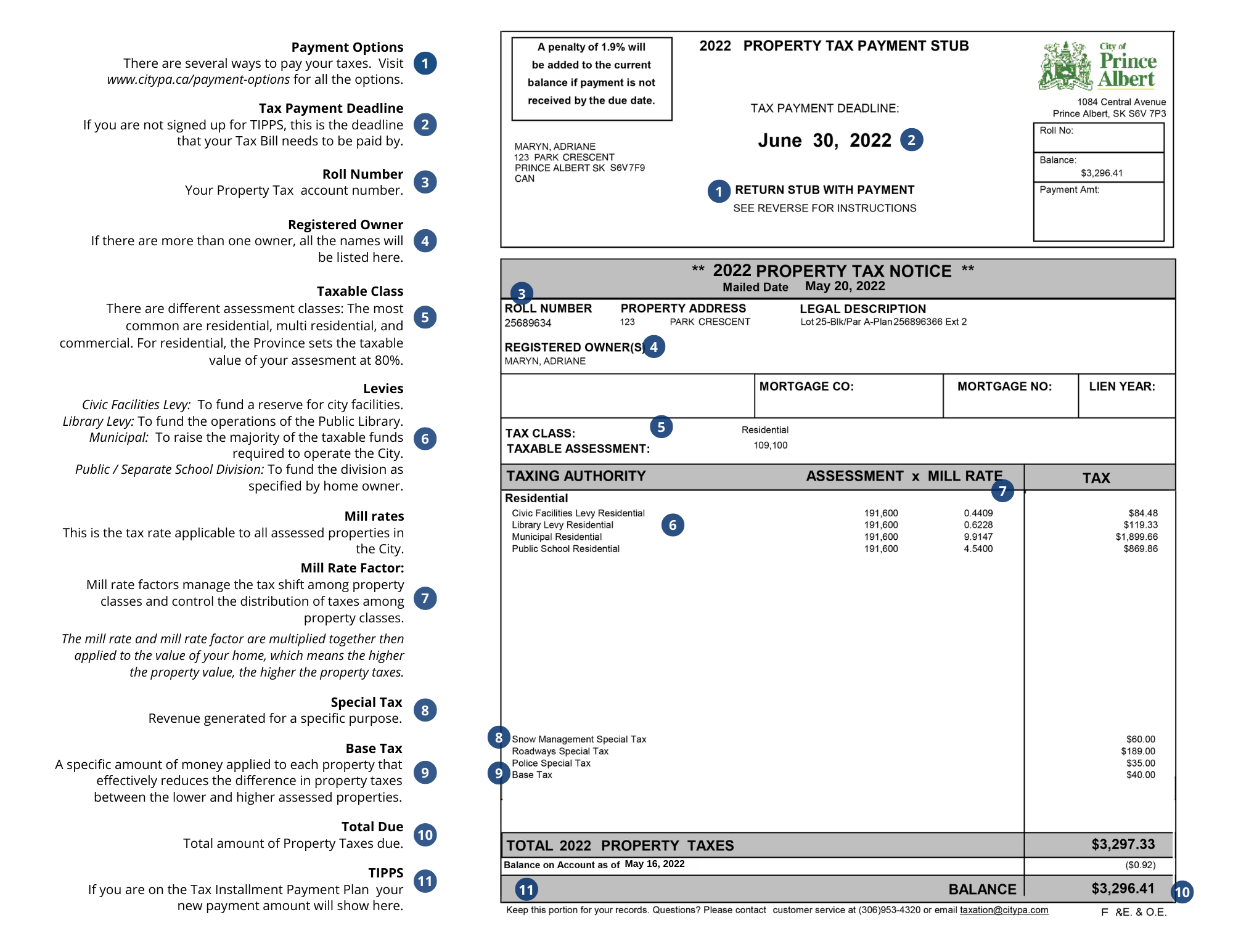

Understanding your Property Tax Notice |

||||||||||||||||||||||

|

Below is a breakdown of all the parts of the Property Tax Notice. The PDF is also available for download here.

|

General Tax Rate Information

| Property Tax Bylaws |

|

The following property tax bylaws are in place for 2023. Property Tax Bylaw The Property Tax Bylaw raises the amount of taxes for General Municipal, Library and Capital Project Levies. It also has the current rates for base taxes, minimum tax and Destination Marketing Levy for Hotels. Snow Management Special Tax Bylaw The Snow Management Special Tax Bylaw establishes the rate of tax to raises funds to cover the expenses of the City’s snow management operations. Roadways Special Tax Bylaw The Roadways Special Tax Bylaw sets the rate of tax to raises funds to cover the annual paving program. Police Special Tax Bylaw The Police Special Tax Bylaw provides the rate of tax to raise funds to cover expenses in the proactive policing unit. Business Improvement District Levy Bylaw The Business Improvement District Levy Bylaw establishes the rate of tax to raise funds for the Prince Albert Down Business Improvement District’s activities. This levy is applied to properties located in the Downtown Business Improvement District area, defined in Bylaw No. 4 of 2005. Property Tax Incentive and Penalties Bylaw Our Property Tax Incentive and Penalties Bylaw identifies all the due dates of taxes, the interest charges, our TIPPS incentive as well as our discount for early payments. |

| School Taxes |

|

The City of Prince Albert is required by legislation to bill and collect school taxes on behalf of the Province. You can make a declaration of whether your education property tax dollars will support the Public School or the Separate School. School board taxes do not have a mill rate factor associated with them. Please see our property tax bylaw to see all the rates associated with your tax notice. |

| Property Tax Estimates |

| Exact taxes for any particular property are not provided. You can find an approximation of taxes by using the property tax estimate calculator. To use the calculator you need to click on Assessment Online, you will need to know the assessed value of a property. |

| Property Ownership |

| If you would like to find out who the owner of a property is, please contact Information Services Corporation. |

| Property Tax Relief |

| Property tax relief may be considered if it meets the criteria listed in the Property Tax Relief Policy. |