Tips on Completing your Form

|

- Keep to the subject of property assessment, as this appeal process is not about the level of taxation or types of City services you are provided.

- When comparing your property to others, describe land parcels, size of buildings, property quality, classification, condition and any other factors that may affect the value.

- When comparing your business property, describe the square footage, neighborhood, age and quality of the buildings where the businesses are located.

|

Payment of Required Fee

|

|

The Appeal Fee is $100 for every Residential Property and Residential Condominium Unit.

For Multi-unit Residential and Commercial/Industrial the Appeal Fees are:

- $200 for an assessed value of less than $500,000.

- $600 for an assessed value of $500,000 to $1,000,000.

- $1,000 for an assessed value of more than $1,000,000.

Payments can be made by cash, cheque or money order to The City of Prince Albert.

|

Submit by Deadline

|

|

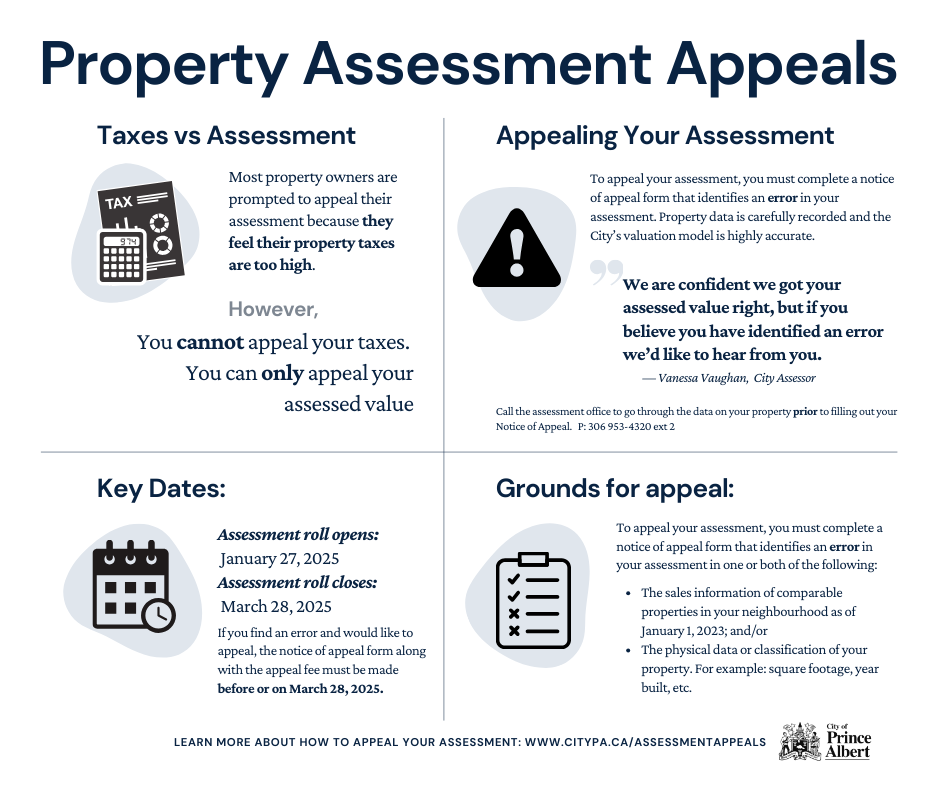

The deadline to submit your completed Appeal form and fee is 60 days from the date the Notice of Assessment was published. It is expected that Notices of Assessment will be sent by January 27, 2025 with the deadline of March 28, 2025.

Submit by mail or in-person to:

Secretary of the Board of Revision

2nd Floor, City Clerk’s Office

1084 Central Avenue

Prince Albert SK S6V 7P3

OR

Drop off at the night deposit box located at the City Hall main entrance.

|

Appeal Hearing Process

|

|

The Secretary will contact you shortly after your appeal is submitted and may request additional information if required.

Once your appeal is accepted, you will be provided with at least 30 days’ notice in writing of the date, time and place that your hearing will take place. More information will be provided to you at that time regarding the hearing process and the opportunity to submit additional materials for the Board’s consideration.

Review past Notice of Hearings |

Final Decisions

|

|

The Secretary will send you a written decision usually within 2 to 8 weeks following the hearing depending on the complexity. All decisions must be made within 180 days after the assessment notices have been sent out.

Review past Board of Revision Decisions

|

Other Important Appeal Information

|

Simplified Appeal Process

|

|

You are eligible for a simplified appeal process if your appeal is for a single family residential property or any property that has a total assessment value of $250,000 or less. If you qualify, this process allows more flexibility with respect to disclosure of materials and evidence. The Secretary will provide details on the process once it has been determined that your appeal is going forward to a hearing.

|

Representation by 3rd Party

|

|

If you, the appellant, want to have someone represent you in dealing with your property appeal, you can name an agent or other chosen representative in your Notice of Appeal when you submit the form to the secretary. This representative can act of your behalf in the course of the appeal process. The property owner will be notified of the final decision.

|

Expert Witness

|

|

Both the appellant and the assessor may call in an expert witness to testify at your hearing. An expert witness must be qualified in his/her area of expertise. If you plan to use a witness, please contact the secretary in advance of the hearing to learn more about the requirements of calling a witness.

|

Agreement to Adjust Assessment

|

|

An agreement to adjust is used to fix an assessment error before the board of revision hearing. Once your appeal has been accepted by the secretary, the assessor may contact you to try to resolve matters under appeal or schedule an inspection of your property, if necessary.

If all parties agree to a new assessed value, an agreement to adjust the assessment is signed. The appeal is withdrawn, and you will be notified in writing by the secretary.

|

Withdrawal

|

|

You can withdraw your appeal at any time prior to the hearing. Your appeal fees will be refunded only if you provide written notice of withdrawal to the Board Secretary at least 15 days before your hearing date.

|

Attendance at Hearing

|

|

If you or your representative does not attend the hearing, it is important to note that you give up your right to appeal the Board of Revision’s decision to the next level of appeal, the Saskatchewan Municipal Board.

Your appeal will be more effective if someone attends to present evidence and answer questions.

|

Hearing Procedure/Process

|

- Hearings are usually held in a designated conference room in City Hall, unless otherwise notified.

- Before the appeal is heard, the Chairperson will explain the hearing procedure, and request that all parties state their name and take an oath or affirmation.

- You will be provided an opportunity to make a brief opening statement outlining the main issues and then proceed to introduce evidence on the specific grounds on which it is alleged that an error in the assessment exists. Subsequent to this, you may be questioned or cross-examined by the Assessor or by the Board.

- The Assessor will then be asked to proceed in the same manner and you will be given an opportunity to cross-examine the Assessor. Any rebuttal evidence must be different from what you have already presented and must be related to the matters raised by the Assessor.

- You will then be asked for a summary of evidence and argument. The Assessor will be asked for the same. You will then be given an opportunity for a final rebuttal/closing statement.

|

Tips on Presenting your Appeal

|

- Keep to the subject of property assessment, as this appeal process is not about the level of taxation or types of City services you are provided.

- When comparing your property to others, describe land parcels, size of buildings, property quality, classification, condition and any other factors that may affect the value.

- When comparing your business property, describe the square footage, neighborhood, age and quality of the buildings where the businesses are located.

- Remember to review the letter from the secretary outlining specific information about your hearing, in particular the deadline dates for the disclosure of evidence.

- Late materials may not be accepted by the Board. In the event that the Board accepts the material for consideration, you must be prepared to provide 5 copies at the hearing.

|

Additional Resources

|

|

Assessment Legislation – Part X of The Cities Act

https://publications.saskatchewan.ca/#/products/408

Property Assessment Appeals information - Government of Saskatchewan website at:

https://www.saskatchewan.ca/residents/taxes-and-investments/property-taxes/appeal-your-property-assessment

Next Appeal level – Saskatchewan Municipal Board

https://www.saskatchewan.ca/government/government-structure/boards-commissions-and-agencies/saskatchewan-municipal-board

|

|