Understanding your Assessment Notice

Please Note: 2026 is a Non-Revaluation Year. Every property owner will not receive an Assessment Notice in the mail.

You can also print it out:

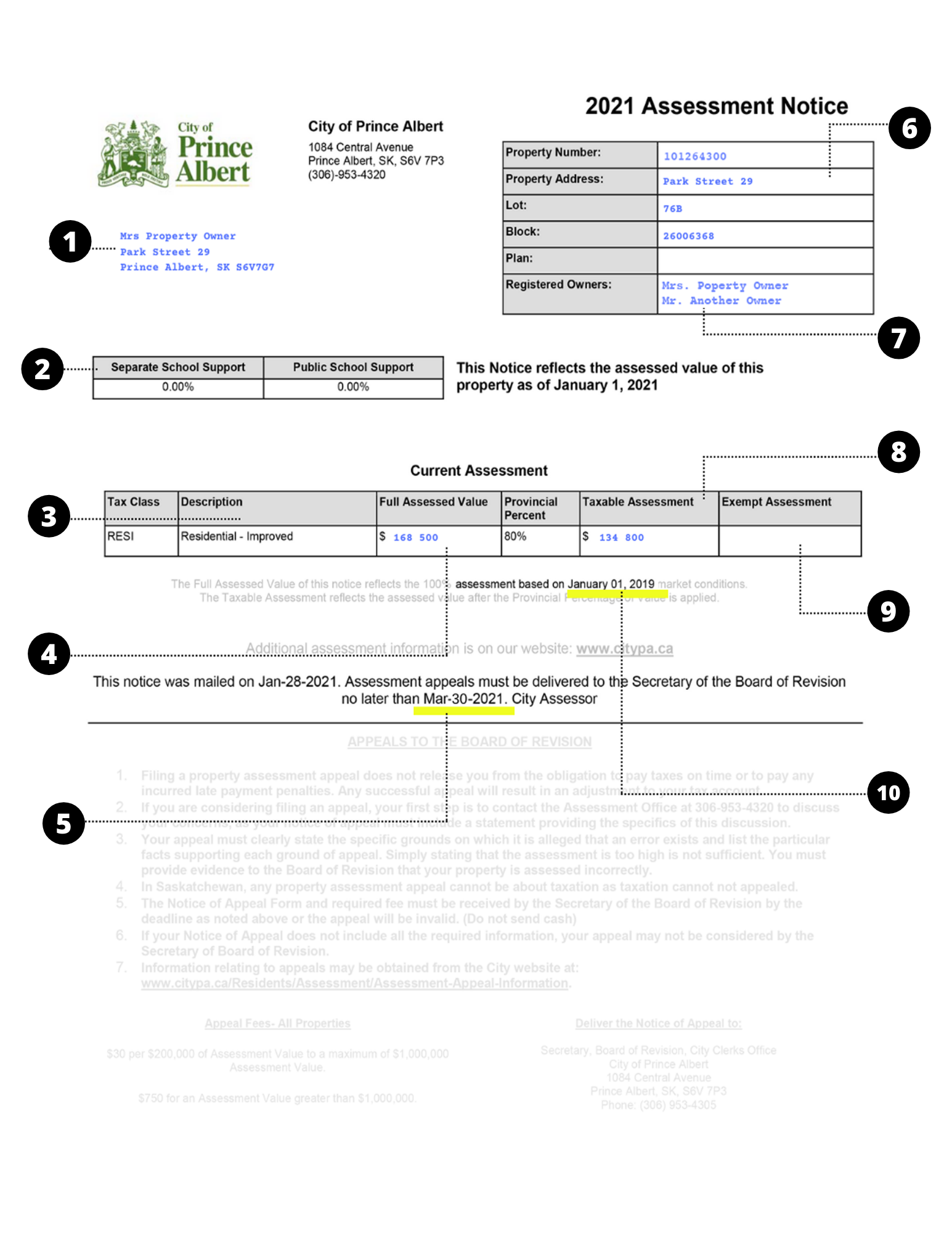

1. Mailing Address:

This area contains the name and address of the primary assessed person that the Assessment Notice is mailed to.

2. School Support:

The percentage of this property’s taxes allocated to the two school boards.

3. Description:

This is the property classification applied to the property.

4. Full Assessed Value:

Your property’s value is determined using Saskatchewan Assessment Manuals and provincial legislation. This is the 100% full estimated market value.

5. Appeal date:

This is the deadline to appeal this assessment.

6. Property Identification:

This area contains information to identify the property:

- Roll Numbers,

- Civic Address,

- Legal Land description,

- All registered owners on title.

7. Assessed Person(s)

These are either the registered owner(s) on title or owner(s) under an agreement sale.

8. Taxable Assessment:

This value is arrived at by multiplying the assessed value by the provincial percentage of value. This value is used to apply a mill rate and a mill rate factor to arrive at the property taxes.

9. Exempt Assessment:

A property may have all or a portion of its assessment excluded from the tax calculation. These exemptions may be granted by specific legislation (e.g.schools, hospitals) or by City Council agreement.

10. Base date:

The base date established by the Agency through a Board Order for the purpose of establishing assessment roll.

Contact Us

City of Prince Albert

1084 Central Avenue

Prince Albert, SK S6V 7P3

Phone: 306-953-4884

After Hours Emergency: 306-953-4348

Email Us